Lic of India

For Every Stage of Life

Where Security Meets Trust.

Ensuring Tomorrow

A Promise That Never Breaks

Every Life Deserves Security

Strengthening Families

Looking for Investing in a Life Insurance ?

LIC (Life Insurance Corporation of India) policies offer a range of benefits designed to provide financial security and help individuals achieve their financial goals.

Trust & Legacy

LIC is India’s oldest and most trusted life insurance company, serving millions of families for over 65 years.

Trusted Claim Record

LIC consistently maintains one of the highest claim settlement ratios, ensuring financial security and reliability for policyholders’ families.

Wide Range of Plans

From term insurance to pension, child, health, and investment-linked policies, LIC offers plans for every life stage and financial goal.

Benefits Of Insurance

Life insurance ensures financial security and protection—the two things everyone desires. With its multiple benefits, it remains one of the smartest ways to safeguard your family’s future.

- In case of an unfortunate event, you and your family are protected with a high risk cover

- Sudden demise of a family member leaves the dependents grief-stricken and during such situations financial worries should be the least they should think of. An adequate life cover ensures that one’s family is well taken care of in case of such incidents. The insurer pays up the bereaved family the sum assured along with any bonus or profits, as applicable.

- Under Section 80C of Income Tax Act, investments made in certain specified instruments are subject to tax rebate. Moreover, Section 80C is an effective way by which a salaried person can reduce his/her tax liability. Since life insurance premiums are taken into consideration, it can be a way that will help you reduce your tax burden.

- Certain policies that offer money back benefits helps in keeping your family secure with regular & timely payouts. This income helps in meeting certain regular expenses like rent, bills, loans, etc.

Insurance enables you to effectively plan for every life stage and needs during that stage. Life insurance can be viewed as long term investment instrument that provides solid financial support.

As per your life stage and risk appetite, you can fix and meet all your financial goals whether it is your child’s education, wedding expenses, buying dream home or your retirement- all taken care of.

- Your money is invested in life insurance is safe and returns are paid back on time. It also fetches good returns as the money is returned to the policyholder/beneficiaries as sum assured either on completion of the policy term or death, whichever is earlier.

- As per policy provisions, you can avail loan facility to meet any emergencies. The loan amount can be taken in a percentage of the sum assured of your life insurance.

LIC SERVICES

GET your lic services easier and faster

New Policy LIC

Free Consultation for New Policy for family

Claim Settelment lic

Assistance Claim Settelment in all situation

Premium Payment lic

On time Premium Reminders & Collection

Amendment

policy updates, Address or Nominee Change etc

Revival Policy lic

Assistance in Revival of the Lapsed Policy

Receipt Delivery

Premium Statement or Recipt Delivery

"LIC – India’s most trusted insurance partner in life’s journey."

Relax Tomorrow PLAN TODAY LIC

Types of Insurance

1) Term Life Insurance

Affordable plan with low premiums. Provides the Sum Assured to nominees if the policyholder passes away during the term.

2) Whole Life Policy

Covers the insured for their entire life. Combines protection with an investment component that allows borrowing or withdrawals.

3) Endowment Plan

Offers both death and survival benefits. Pays Sum Assured + profits on maturity or demise.

4) ULIPs (Unit Linked Insurance Plans)

Market-linked plan combining insurance and investment. Pays Sum Assured on death or maturity.

5) Money Back Policy

Provides periodic payouts during the policy term. Nominees get the full Sum Assured on death, while survivors receive the remaining balance at maturity.

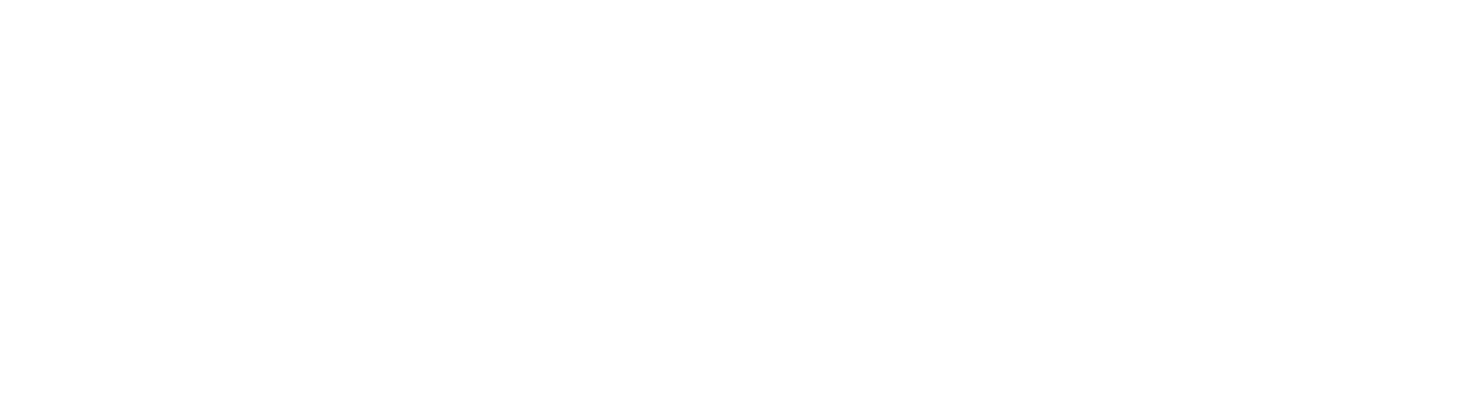

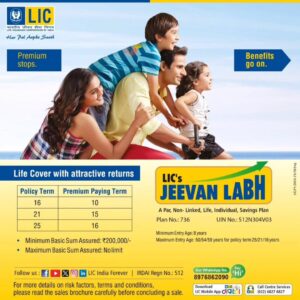

BEST INSURANCE PLANS

lic of india

Talk with us

Any Question? Feel Free to Contact For comprehensive solution of Life Insurance for your family, please contact now.

LIC OFFICE,

SECTOR 11, GANDHINAGAR, GUJARAT, INDIA.

+91 903386 2152, +91 982581 4190